Get a Degree, Not Debt

In partnership with:

we can help

your student:

- Find the right major, career, and calling

- Identify the right colleges

- Apply strategically to enable the best offers

- Learn the power of the interview and stories

- Negotiate and appeal for higher scholarships

- Find the best loans (and releasing the co-signer)

- Continue the process for undergrad and grad school

The New Realities

Many young people cite that they are delaying marriage for 5 years or more due to student loans debt. Debt is also one of the leading causes of failed marriages.

Few ministries will accept students who have pre-established amounts of debt.

College debt is delaying first-time home purchases. The average age of first-time home buyers has gone from twenty-three to age twenty-nine in the last fifteen years.

Over 50% of college graduates are working one or several non-degree-related jobs to pay off student loans.

30% of graduates move in with their parents for more than a year.

20% of graduates with student loan debt are behind in their payments.

In the past 12 years, student debt has surpassed credit card debt, and has increased from $200 Billion to $1.6 Trillion!

About College Assistance Plus

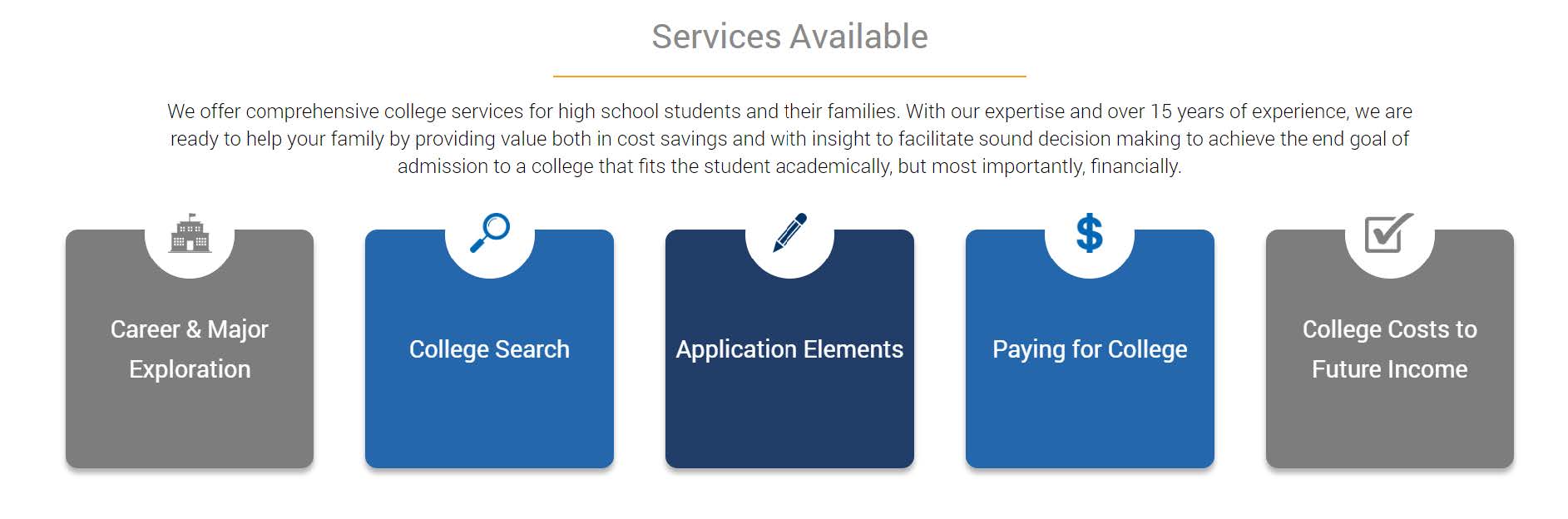

Paul Celuch had been teaching Crown Financial Ministries classes as a result of his friendship with Larry Burkett and started College Assistance Plus in 2004 in response to the student debt that was impacting young adult lives. John Decker joined the CAP team in 2010 while pursuing the college transition mission that is now Every Student Sent. CAP provides free Zoom strategy sessions for individual families, churches, and schools, and services for families that range from $250 to $3500.

Steps for Students to Minimize Debt

High School

Identify potential careers and majors early.This will help students choose the right direction. The constant switching of college majors has increased the average time it takes to complete a degree from 4 years to 5.5 years. Another lap around the track can cost big money! Also, poor choices for careers/majors are so common that 52% of last year’s college graduates were unemployed, or working jobs that do not require a college degree.

Select the right college. Look at a wide range of colleges before becoming emotionally attached to a specific university. Good private colleges often are willing to reduce their price substantially.

Get the best initial offer. Set up an interview with a department head who is able to put some pressure on financial aid. Be consistent and compelling during interviews and admissions essays. Get some coaching beforehand if possible.

Negotiate a better package. Certain schools compete with other colleges on specific programs. Find out which colleges those are and apply to those where you know you can get a lower price. This helps to establish value in the marketplace. Use this when appealing for a lower tuition.

Connect with good study partners and campus ministries before you arrive. Over 26% of college freshmen drop out during their freshman year, usually because they are unable navigate their new freedom and social environment. Academics suffer and students lose scholarships. Furthermore, 70% of Christian freshmen leave the faith in their first year on campus. Connecting with a campus ministry and finding friends who follow Jesus is key to continuing to grow in the faith throughout college. Becoming involved in these groups early is essential. You can find and connect with ministries now atwww.EveryStudentSent.org.

In College

If you have an excellent GPA, it’s possible to use the above process to further reduce your tuition. You can also use this same approach with graduate schools.

Graduated

There are new ways to consolidate and refinance existing federal and private student loans.

Help your younger siblings and friends by sharing this information about the business of college.

To Learn More, Schedule a Free Strategy Call or Attend the Weekly Webinar, fill out the form below.